As the old adage goes, “Cash (flow) is king.”

For business owners, understanding cash inflows and outflows is critical for making financial decisions. Creating a cash flow statement gives you a bird’s-eye view of your company’s finances. Along with your income statement and balance sheet, it can help you estimate profitability and evaluate the need for funding.

On the other hand, you risk unexpected financial issues, liquidity problems, and missed opportunities without a clear view of your business’s cash flow.

What is a cash flow statement?

A cash flow statement summarizes your company's cash inflows and outflows. It’s a snapshot of the amount of cash entering and leaving your business, enabling you to evaluate its financial health.

Typically, you create a cash flow document every month, quarter, or year.

This financial statement is divided into three main business activities:

- Operating activities

- Investing activities

- Financing activities

Each section details the cash generated or used by different business functions, giving you insights into your company’s liquidity, solvency, and overall financial performance.

Why is a cash flow statement important?

A cash flow statement is a helpful tool for business leaders. Its functions include:

- Assessing financial health

- Informing decision-making

- Assisting with budgeting and forecasting

- Helping to attract investors

A cash flow statement helps you evaluate your company’s financial health by showcasing its ability to generate revenue and meet financial obligations. A positive cash flow indicates a healthy business, while a negative cash flow may signal potential problems.

This document will help you understand where your money is coming from, where it goes, and if you need to make adjustments. Additionally, your cash flow statement forecasts future revenue and assists with creating future budgets.

For example, say the statement reveals a positive cash flow of $1k from operating activities. But your cash outflow of $900 is high because you’ve invested in new equipment and inventory.

What if your company’s new equipment doesn’t end up generating additional cash flow? The $100 positive difference might stagnate or even decrease, leading to potential losses. However, you could consider further investments in other areas.

What goes into cash flow statements?

Three components come together to form a cash flow statement:

Operating activities

This represents your core business operations. Cash flow here comes from selling products or providing services, minus operating expenses. This part of your statement is akin to your business’s heart rate, reflecting the viability of your business model.

Investing activities

The cash flow from investing activities sums up the cash used or received from investments. For example, it’s money you spend on assets like machinery, real estate, or cash you gain from the sale of assets.

Consider it a summary of your investment performance.

Financing activities

Lastly, the cash flow from financing activities shows the cash from your financial dealings. It includes money from loans or investors minus payments made to shareholders or loan repayments.

This section uncovers your business’s ability to balance debt, equity, and dividend payments. Essentially, it’s your financial balancing act in numbers.

Cash flow formulas

There are two ways to calculate net cash flow: indirect and direct. Both can be used for a cash flow statement, but the calculations can show you different information.

Indirect method

The indirect method keeps finances simple by starting the calculation with net income rather than listing out all cash receipts.

The main benefit of starting with net income is convenience. A step-by-step explanation of the indirect method:

- Start with the net income from your financial statement

- Add back non-cash expenses, like amortization and depreciation

- Adjust for changes in working capital, including accounts receivable, inventory, and accounts payable

- Add or subtract cash flow from investing and financing activities

Since the indirect method starts with net income, it doesn’t show as much detail as the direct method. However, most companies choose the indirect method because it’s easier — the direct method requires you to view and calculate each cash transaction when calculating net cash flow.

Direct method

The direct method offers a more detailed view of cash transactions by showing cash inflows and outflows from operating activities. You’ll need access to cash transaction data, including the cash receipts you pay suppliers and those you receive from customers.

Here’s how to calculate cash flow using the direct method:

- List cash receipts from customers

- Deduct cash payments to suppliers, employees, and other operating expenses

- Calculate cash flow from operating activities

- Add or subtract cash flow from investing and financing activities

You’ll gain a deeper understanding of operating inflows and outflows using the direct method. For instance, you would know if your cash flow changed because a supplier charged less or because a store is selling more. Then, you could adjust your strategy moving forward.

However, you’ll need to spend more time gathering bookkeeping numbers to achieve the same result as the indirect method.

How to make a cash flow statement

1. Choose how often you’ll make cash flow statements

Decide how often you want to create a statement. Daily? Weekly? Monthly? Like getting maintenance done on your car, regular statements help you address issues early.

Megan Dunn, vice president of finance at employee reimbursement platform Compt, recommends most businesses focus on the big picture rather than minor details. Unless your company is in a tight financial spot, weekly cash flow statements can effectively assist with forecasting, identifying funding needs, and planning for worst-case scenarios.

2. Gather data from the three types of financing activities

Next, gather your data. This is where you’ll collect your cash receipts for the direct method or net income statements for the indirect method.

For your operating activities, include your total revenue from your income statement and expenses like employee salaries, production costs, or rent.

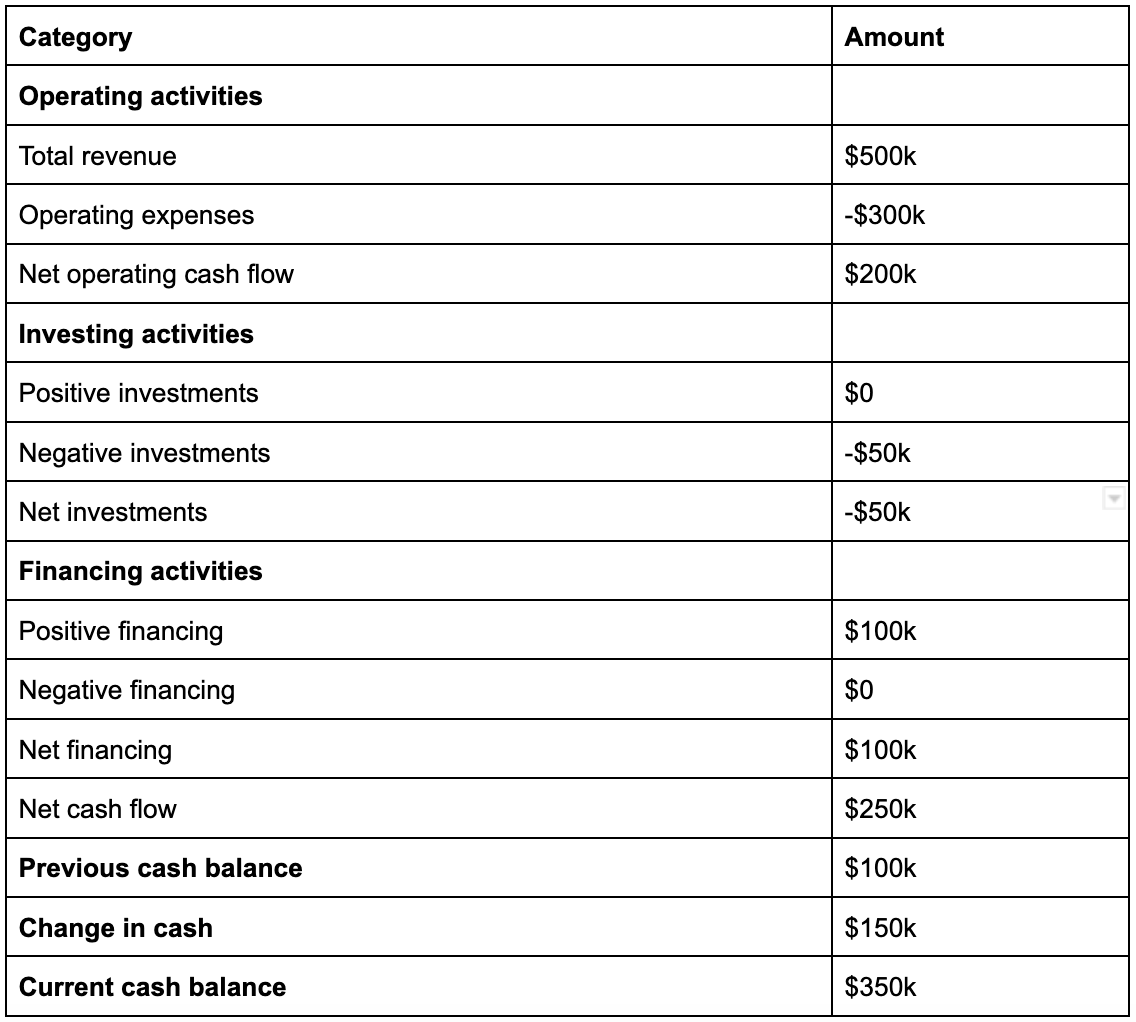

For example, say you made $500k in revenue this year and spent $300k in operating expenses. For your operating activities, you’ll net $200k.

Your investment activities might be investment properties, stock purchases, or equipment. Using the same example, say you invested $50k into a factory. You’ll net -$50k for investments.

Lastly, your financing activities will include seed rounds, loans, liabilities, or dividend payments to shareholders. Assume you received $100k in funding for the year.

3. Calculate the net cash flow

Now that you’ve collected the numbers, it’s time to crunch them. Net cash flow is the sum of your income or expenses from operating, investment, and financing activities.

Here’s what the example would look like:

$200k + (-$50k) + 100k = $250k in net cash flow.

4. Determine the overall change in cash for the period

Your overall change in cash is the last part of the cash flow statement, showing how much you’ve increased or decreased cash reserves. It’s a snapshot of your company’s liquidity from each accounting period, enabling you to track changes in your company’s cash flows month over month, year over year.

You calculate it by subtracting the starting cash balance for the time period from the ending cash balance (net cash flow).

For example, assume the previous cash balance was $100k, and the net cash flow for this period is $250k. When you subtract the $100k, you get a positive change in cash of $150k.

Cash flow statement example

Now that you have the data, it’s time to put it into graph form and compare it to past and future statements. The easiest way to convert raw numbers into graphics is via Excel or Google Sheets.

Here’s a simple way to format your cash flow statement using the example from earlier:

How to use a cash flow statement

Think of cash flow statements as your GPS. They tell you where you’ve been and help you chart where you’re going.

Say your cash from operating activities has gradually decreased in the past few quarters. This could be a red flag signaling your core business operations might not be as profitable as they once were.

Whether it’s because of more competition or economic concerns, this insight would help guide your decision-making.

Additionally, cash flow statements are great for analyzing your company’s liquidity or cash equivalents — how easily you can pay your bills.

For example, say your ecommerce company consistently generates enough revenue for employees’ paychecks, product costs, and office rent. However, if revenue drops and your profitability shrinks, it might be time to rethink marketing strategies, cut operational costs, or seek additional funding.

Lastly, cash flow statements gauge your company’s solvency and financial health. The question is — can you meet your long-term obligations?

If your business constantly needs new funding because your cash flow isn’t positive, you have solvency issues. Regular cash flow statements keep you aware of the problem and allow you to make adjustments quickly.